Reliable Financial Obligation Collection by Credifin: Solutions That Job

Wiki Article

Efficient Strategies for Funding Collection: Recover Your Debts

Are you having a hard time to recover your arrearages? Look no more! In this post, we will give you with reliable approaches for finance collection. You will certainly learn exactly how to recognize financial obligation recovery methods, build better communication with consumers, implement a structured collection process, make use of technology for reliable debt monitoring, as well as browse lawful considerations. With these actionable pointers, you can take control of your lending collection procedure and effectively recuperate your financial obligations.

Comprehending Financial Debt Healing Strategies

To successfully recoup your financial obligations, you require to recognize financial obligation recovery techniques. By acquainting on your own with these strategies, you can enhance your opportunities of successfully fetching the money owed to you. One essential technique is communication. Keeping open lines of interaction with the borrower allows you to establish a discussion as well as work out a payment strategy. It is essential to be assertive yet respectful throughout these discussions, making it clear that you anticipate repayment while also using flexibility if needed.Another effective debt recuperation strategy is paperwork. Maintaining in-depth documents of all communications, arrangements, as well as payment background is vital. This documentation can work as proof in case legal activity becomes required. Additionally, it helps you stay arranged and track the progress of your financial debt collection efforts.

Making use of the solutions of a debt collection firm can significantly improve your opportunities of successful financial debt healing. These agencies have the experience and resources to manage the collection procedure in your place. They employ numerous methods, such as miss mapping as well as debt coverage, to situate borrowers as well as motivate timely settlement.

Building Efficient Communication With Debtors

Beginning by connecting to your consumers in a pleasant as well as specialist fashion. Let them know that you recognize their arrearage which you want to collaborate with them to discover an option. Program compassion and also understanding towards their circumstance, yet additionally make it clear that you anticipate the financial obligation to be repaid.

During your conversations, make sure to actively listen to what your borrowers have to state. Ask open-ended questions to motivate them to share their obstacles and also concerns - credifin. This will certainly aid you obtain a far better understanding of their financial situation and allow you ahead up with a suitable repayment plan

Maintain routine call with your customers throughout the financial debt healing process. This will help them really feel supported and also will certainly likewise offer as a reminder of their commitment to repay the financial obligation. By staying in touch, you can address any type of problems or concerns that might arise and maintain the lines of communication open.

Implementing a Structured Collection Refine

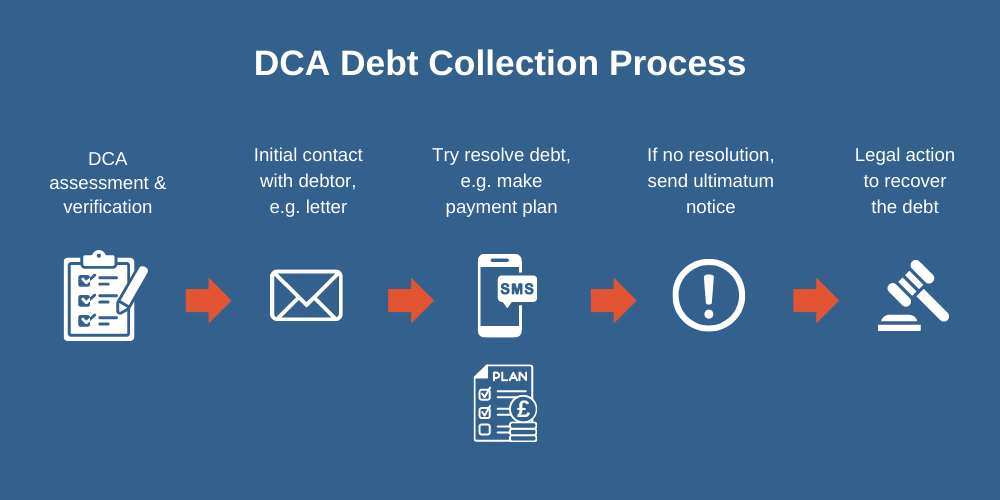

By carrying out an organized collection procedure, you can simplify the financial debt healing procedure as well as raise your possibilities of obtaining back what is owed to you. Having a structured technique means having a clear strategy in place to manage financial obligation collection. This involves establishing up details steps and also treatments to comply with when managing customers that have arrearages.It is essential to establish a timeline for financial obligation collection. over at this website This timeline must detail the specific actions that require to be taken at various phases of the procedure, such as sending out suggestions, releasing warnings, or perhaps taking lawful activity if essential. By having a clear timeline, you can make certain that you are continually and also proactively pursuing the recovery of the financial debt.

Applying an organized collection process suggests having a systematic technique to paperwork and record-keeping. This includes keeping exact records of all interactions with customers, as well as any kind of agreements or assurances made relating to repayment. Having these documents conveniently offered can aid you track the progression of each instance as well as supply evidence if lawsuit ends up being necessary.

A structured collection process involves normal web link tracking as well as examination. This indicates on a regular basis examining and examining the performance of your collection efforts. By recognizing any type of locations of enhancement or patterns in debtor actions, you can make required modifications to your strategies and also boost your possibilities of effective financial debt healing.

Using Modern Technology for Effective Financial Debt Management

Making use of technology can significantly boost the performance of handling your financial obligation. With the improvements in modern technology, there are now a variety of sources as well as devices offered to assist you streamline your financial obligation administration process. One of the most reliable ways to utilize innovation is by utilizing financial obligation administration software.Legal Considerations in Loan Collection

When it comes to recouping your financial obligations, it is crucial to understand the legal facets entailed. It's likewise crucial to familiarize on your own with the Fair Financial Debt Collection Practices Act (FDCPA), which sets guidelines on just how financial obligation collection agencies can communicate with consumers. By recognizing and also following the legal considerations in loan collection, you can guarantee that you are operating within the borders of the legislation while maximizing your possibilities of recovering the financial obligations owed to you.Verdict

In verdict, by executing effective techniques for funding collection, you can efficiently recoup your financial obligations. By following these strategies, you can enhance your opportunities of effectively recovering the financial debts owed to you.You will learn just how to comprehend financial obligation healing techniques, construct much better interaction with borrowers, apply a structured collection process, use technology for efficient financial obligation management, and browse lawful factors to consider. To successfully recoup your financial obligations, you require to recognize debt recuperation methods. Making use of the services of a financial debt collection agency can considerably improve your possibilities of successful financial obligation recuperation. It's also important to familiarize yourself with the Fair Financial Obligation Collection Practices Act (FDCPA), which establishes guidelines on how financial obligation collection agencies can engage with debtors. By understanding and also adhering to the legal considerations in funding collection, you can make see post certain that you are operating within the borders of the regulation while optimizing your opportunities of recovering the financial obligations owed to you.

Report this wiki page